Published 13 May 2022

By Tui Eruera, Founder and CEO of Jaaims

Let’s talk about sand. Yes, sand. Not the stuff we use to make castles on the beach. But rather, sand that is a basic building block of construction. It’s something investors would do well to keep an eye on.

Mention ‘resources’ and we tend to think of coal, iron ore or crude oil. Yet every year, 50 billion tonnes of sand globally are mined for use in concrete, glass and other construction materials.

It makes sand the world’s most-used resource, second only to water [1].

However, our appetite for sand has led to a global shortage.

Stroll along any Aussie beach – we have almost 12,000 of them, and it’s hard to imagine how the world could be facing a serious shortfall of sand.

The catch is that not all sand can be mined.

A United Nations report says keeping sand on coasts may be the most cost-effective strategy for climate adaptation because it protects against storm surges and sea level rise [2].

What about the sand available in deserts? It’s too fine for concrete, which requires jagged sand that binds well with other materials.

Demand set to soar

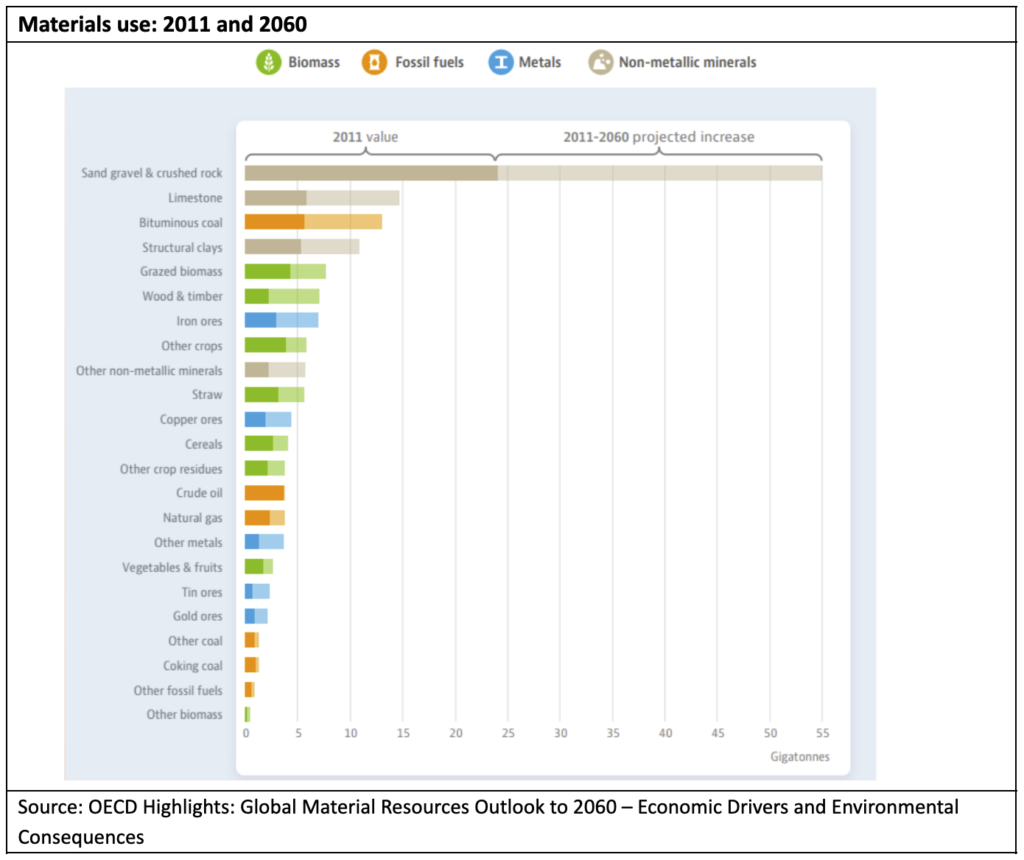

Despite the shortage, over the next 40 years, demand for sand is forecast to surge 45% [3]. An OECD report puts this in perspective. As the chart below shows, between now and 2060, the growth in demand for sand will eclipse every other material – from crude oil and cereal crops, through to fruit or vegetables.

This escalating demand reflects more than construction trends.

A number of countries are opting for naturally available shale gas in order to reduce their dependence on crude oil. Shale gas is extracted using hydraulic fracturing (‘fracking’) where sand is used as a proppant. As a result, growth in shale gas production will further drive demand for sand [5].

Cost of sand rises

As sand becomes scarcer, it is becoming more expensive.

This has already been happening for some time [6]. A decade ago, sand cost around $US7.30 per metric ton. By 2021, the price had reached $US9.90 [7].

The upshot is that growing demand coupled with a rising price is creating opportunities for investors keen to take a long term perspective.

Already, we’ve seen Jaaims take a long position on Australia’s biggest sand miner – Iluka Resources. Its stock price has risen from $8.44 to $9.53 in the last 12 months – a gain of 13% [8].

Other ASX-listed stocks poised to benefit from the sand market include Rio Tinto, which has stakes in heavy mineral sands extraction and refining.

Seeking opportunities in an inflationary world

As we enter an unfamiliar (for many investors) world of high inflation and rising interest rates, it pays to be mindful of long term opportunities. Yes, inflation will come under control – but not in a hurry.

In the meantime, Jaaims’ ability to process, and make sense of, vast quantities of data at exceptional speed, is helping our investors identify opportunities they may have overlooked. And unlike footprints in the sand, this can have a lasting impact on wealth creation.

–

[2] https://news.un.org/en/story/2022/04/1116972

[3] https://www.newscientist.com/article/2313170-we-are-running-out-of-sand-and-global-demand-could-soar-45-by-2060/

[4] https://www.oecd.org/environment/waste/highlights-global-material-resources-outlook-to-2060.pdf

[5] https://www.imarcgroup.com/silica-sand-manufacturing-plant

[6] https://www.statista.com/statistics/219381/sand-and-gravel-prices-in-the-us/

[7] https://pubs.usgs.gov/periodicals/mcs2022/mcs2022-sand-gravel.pdf

[8] https://www2.asx.com.au/markets/company/ilu

*Any advice provided is general in nature and does not take into account the viewer’s specific needs and circumstances. Returns quoted are based on past performance and are not necessarily indicative of future returns. You should consider your own financial position, objectives and requirements to determine the type of advice and products to best suit your needs. Jaaims Australia is an Authorised Representative of Jaaims Technologies, AFSL 519985.