Written by Tui Eruera, CEO and Founder of Jaaims

Published 18 May 2023

War always comes with a terrible human toll. But it’s natural to question how investors can build defences if conflict arises. The war in Ukraine provides valuable insights.

It’s been more than a year since Russian tanks rolled into Ukraine – an anniversary few Ukrainians (or people of many other nationalities) would have celebrated.

A conflict of this scale hasn’t been seen in Europe for decades, and while history tells us that war can be both a wealth builder, and a wealth destroyer, the situation is very different today than in the past.

Nations are more interconnected by trade, technology allows us to stay abreast of events in real time 24/7, and far greater numbers of Australians have a financial interest in stock markets globally.

So, while it may seem callous, it’s natural to consider how we can build financial defences against possible future conflicts.

That’s where the invasion of Ukraine comes in.

From Russia’s capital control measures, to skyrocketing commodity prices, inflation and splintered supply chains, we can gain valuable insights for the road ahead.

Russia demonstrates the ability of nations to control currency

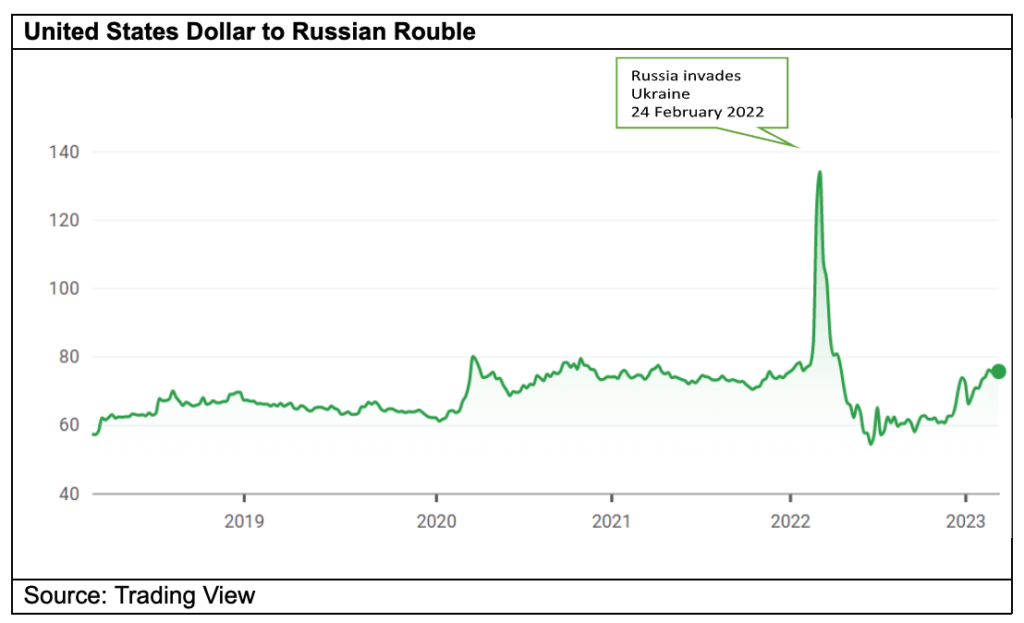

No one will be surprised to learn that Russia’s invasion of Ukraine saw the Russian rouble nosedive against the greenback.

Pre-invasion, the US dollar was worth around 76 roubles. By March 2022, it was buying about 134 roubles – a massive movement for a currency, and a serious shock for anyone with wealth tied to roubles.

Despite the hit to Russia’s currency, the rouble rebounded remarkably rapidly supported by capital controls and an influx of petrodollars.

Russia’s central bank prevented a flight of capital by immediately ratcheting interest rates up from 9.5% to 20%. In addition, authorities acted swiftly, instructing Russian exporters to sell 80% of their foreign currency revenues.

While this helped offset the freezing of Russia’s $US300 billion ($440 billion) overseas reserves and maintain some value to the rouble, a surge in energy prices kept Russia’s budget healthy.

As a country that relies heavily on exports of natural resources, Russia’s ability to (a) control its currency, and (b) maintain exports, has been critical.

Yes, the central bank stepped in to support the currency. But despite a slew of Western sanctions, Russia still has plenty of paying customers.

India, China and Turkey all ramped up their purchases of Russian oil in 2022, a market made more attractive by Russian oil selling at a significant discount to the global benchmark Brent crude.

Meanwhile, Russia has been asking its unsympathetic export customers to pay in roubles. And, as Russia’s imports have softened thanks to an exodus of foreign companies and Western sanctions, its current account surplus has hit new highs. This has helped to bring the rouble right back to where it sat just over a year ago.

The lesson here is that no matter how unfair, illegal or unwarranted a conflict may be, there will always be nations that are happy to keep trading with the aggressor, regardless of how sanctioned it may be.

Energy prices are extremely vulnerable to conflicts

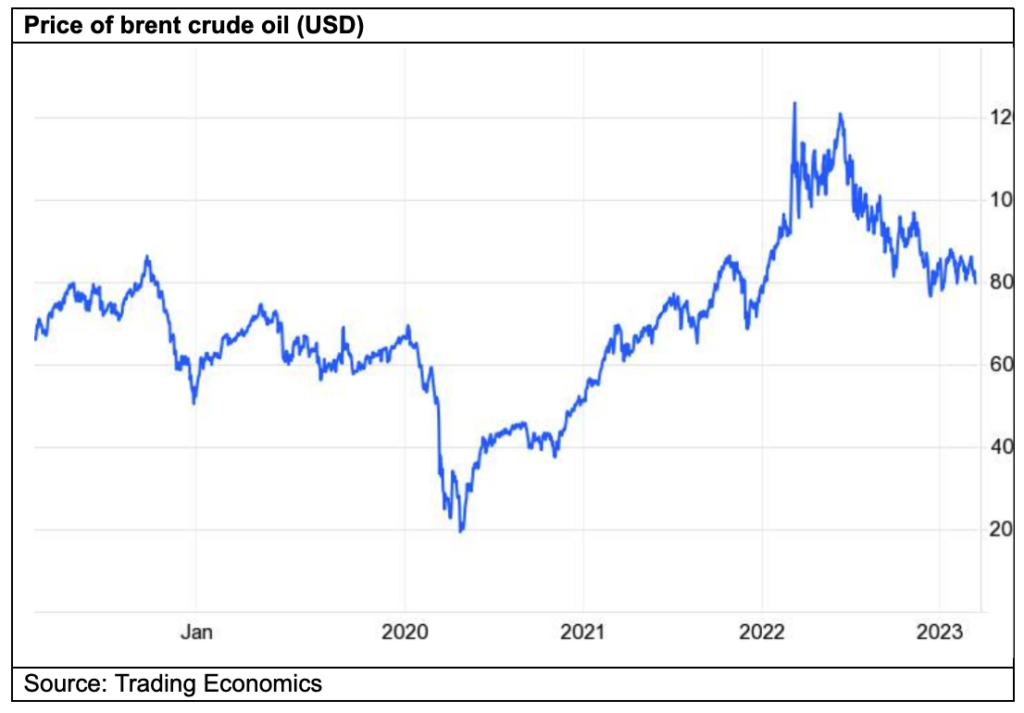

In the wake of the invasion of Ukraine, global oil prices soared. Brent crude spiked from $US78 to $US128/barrel.

Yet a year later, in mid-March 2023, Brent crude is back trading at around $US80. This is despite the imposition of Western sanctions on Russia – the world’s biggest oil exporter.

Reuters[1] explains what has happened, noting that Russia’s crude and fuel exports have been redirected to South and East Asia, while former markets in Europe have been backfilled with crude from the Middle East and Asia.

Events in Ukraine have put global fuel supplies in sharp focus, exposing the lack of oil reserves among many developed nations including Australia.

International Energy Agency (IEA) guidelines require Australia to hold oil stock levels equivalent to no less than 90 days of net imports[2]. Yet IEA data shows Australia holds just 60 days of reserve – the lowest by far across IEA member nations[3]. New Zealand, with the second lowest reserves, holds 93 days’ worth of oil.

Here is another key learning. One of the big winners of conflict are energy companies. But for nations such as Australia, energy remains a key security issue.

Food security is crucial

Food is one of the most important resources for any nation. Here in Australia, we are lucky to produce much of our own food.

That’s not the case for every country, and the Ukraine conflict has worsened the vulnerabilities of food systems already weakened by climate change and COVID-19.

A blockade on Ukrainian exports of staples such as wheat and edible oils (of which Ukraine is a leading producer) has fuelled market shocks, and drawn attention to the vulnerability of food supplies.

As the war drags on and the stakes become higher, our views from 2022 on “Why ag stocks are looking attractive” still hold true.

Severing ties – lessons learned

As noted earlier, global trade ties mean nations are increasingly interdependent. Russia has capitalised on this, responding to trade sanctions by shutting down its gas supplies to Europe through the Nord Stream pipelines.

This has hurt Europe – and in particular Germany, which has become increasingly reliant on Russian gas for its energy needs. This has led to higher heating costs for households across the EU, pushed up manufacturing costs, and increased reliance on coal (which had been due to be phased out).

The gas crisis in Europe has even prompted draconian measures such as limiting the use of lighting and heating in public buildings during winter.

The key takeout is to be alert to businesses that allow themselves to become too dependent on, or exposed to, any single market or producer. It’s a lesson many countries in Europe and Africa are still grappling with.

So…where is China at with Taiwan ?

Will China invade Taiwan? It’s the million-dollar-question of the moment. And while we can speculate over it, the reality is that only Xi Jinping knows the answer.

What we can say with some certainty is that a Chinese invasion of Taiwan would be costly to both sides.

Analysis by the Center for Strategic and International Studies[4] suggests the US would win in a war against China (over Taiwan). But it would be a pyrrhic victory, bringing such a devastating toll on the US and its allies that it would be victory in name only.

Let’s hope it’s a reality we don’t have to face.

Applying the learnings to our algorithm

Russia’s invasion of Ukraine has sent shock waves around the world. But at any given time there is conflict in some part of the globe.

The war in Yemen is in a nervous limbo following a lapse in the truce between Huthi rebels and the internationally recognised government. Ethiopia’s northern Tigray region is enjoying a fragile peace in a war that has cost many thousands of lives. Pakistan is facing an election year at a time when the nation is deeply politically divided.

And yes, Taiwan remains a flashpoint.

Although every conflict is different, investors can take learnings from each situation.

The Ukraine conflict has shown us that some of the first moves made by nations under threat will likely be currency control followed by energy and food security.

This provides the foundation we need to pivot our investment strategy.

Our analysis team has been applying these learnings to our algorithm in readiness for our next major update schedule in the second half of 2023.

[1] https://www.reuters.com/business/energy/oil-market-has-fully-absorbed-impact-russias-invasion-ukraine-kemp-2023-03-09/

[2] https://www.iea.org/data-and-statistics/data-tools/oil-stocks-of-iea-countries

[3] https://www.iea.org/data-and-statistics/data-tools/oil-stocks-of-iea-countries

[4] https://csis-website-prod.s3.amazonaws.com/s3fs-public/publication/230109_Cancian_FirstBattle_NextWar.pdf?VersionId=WdEUwJYWIySMPIr3ivhFolxC_gZQuSOQ

*Any advice provided is general in nature and does not take into account the viewer’s specific needs and circumstances. You should consider your own financial position, objectives and requirements to determine the type of advice and products to best suit your needs. Jaaims Australia is an Authorised Representative of Jaaims Technologies, AFSL 519985.