Publish date 16 November 2021

With the world racing to slash carbon emissions to fight climate change, the concept of socially responsible investing has gained enormous traction across the globe. As a result, an increasing number of investors are looking for companies that give high importance to environmental, social, and governance (ESG) issues and adopt the ESG framework.

Moreover, investors are looking for additional alternative investment options that complement their environmental sustainability objectives.

Ethical Investing with Jaaims

Modern-day investors want to know where the Companies are investing their money. This helps investors find companies whose investment objectives align with their goals, to ensure that their money is ethically invested.

Jaaims offers an automated online trading application – Jaaims – which is powered by an artificial intelligence (AI) algorithm to make buying and selling decisions on behalf of users. Among the many critical features of Jaaims are its ESG tools, which allow investors to keep track of the activities that companies are involved in. These ESG tools enable users to see if companies are meeting their ESG expectations by revealing their ESG performance score.

Jaaims introduces ESG score feature

Jaaims has recently launched sophisticated stock fundamentals, which include ESG investing capabilities. This latest feature from Jaaims shows users ESG scores.

Moreover, the platform also shows the ESG performance summary of the company across three categories, including Underperformance, Average Performance and Over performance. Jaaims also enables users to identify key risk industries like the production of Palm Oil, Coal, Weapons, etc.

Jaaims also plans to modify the Smart Portfolio in the coming weeks, where users will be able to filter out the stocks that may not meet their ESG goals.

RELATED ARTICLE: What sets Jaaims apart from other trading platforms?

ESG rating and scale

ESG risk rating helps investors in determining to what level a company’s enterprise business value is at risk in light of by ESG issues. The rating utilises a two-dimensional structure that mixes the assessment of a company’s exposure to industry-specific material ESG issues with the assessment of the company’s ability to manage those issues.

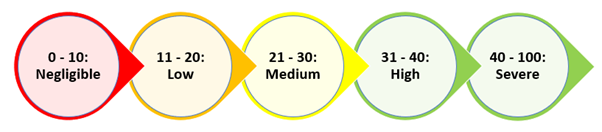

The resultant ESG risk rating scores can be used to measure the unmanaged risk on an absolute scale of 0-100, wherein the lower score indicates less unmanaged ESG risk as shown below:

With Jaaims, users can easily assess the ESG performance of a Company as compared to its peers.